Washington State Long Term Care Tax — What You Need to Know

Washington State recently passed a new law called the Washington Long Term Care Trust Act, which requires employees to contribute a new payroll tax that will tax people’s wages to pay for some long-term care benefits in the future. The law is mandatory and will cost $0.58 on every $100 of wages. The new tax will start January 1, 2022.

What is the Washington State Long Term Care Trust?

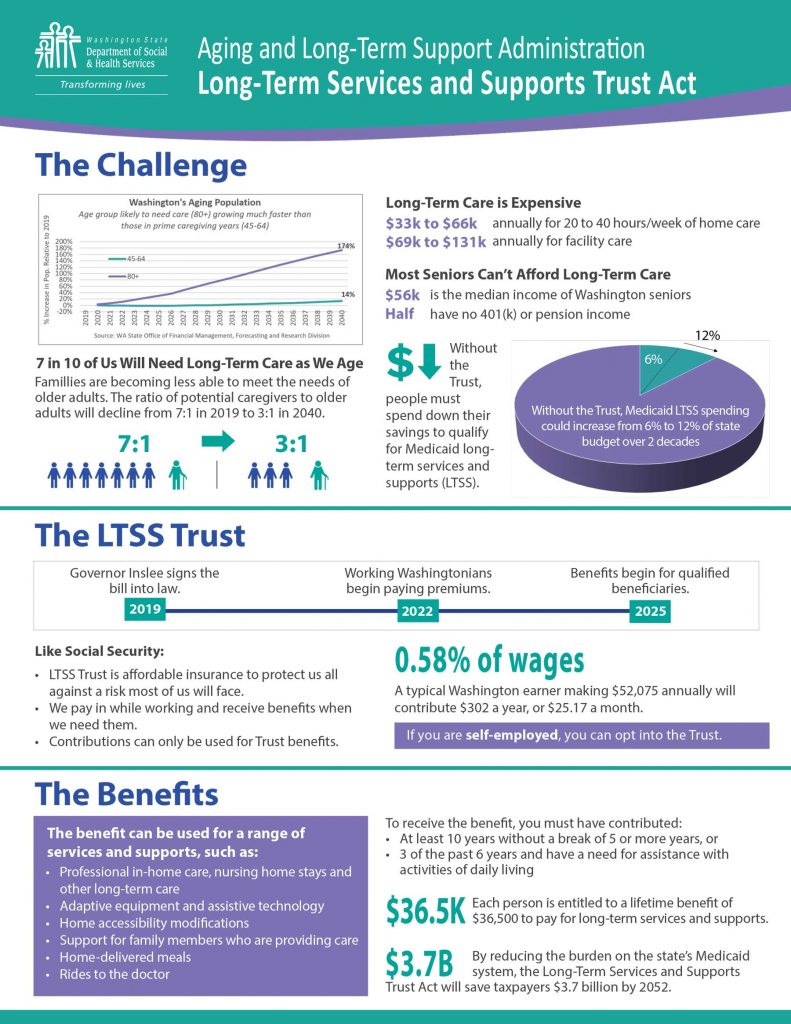

The trust is designed to provide eligible Washington residents with up to $100 per day, with a maximum lifetime limit of $36,500, to pay for long-term care services including professional care at home or nursing facilities. Here’s a graphic outlining why the trust was created.

Who will the Long Term Care Trust benefit?

People who have a need for long-term services and supports may begin applying for benefits in January 2025. To qualify for benefits, you must have met the WA Cares contribution requirements by the time you apply. You must also need help with activities of daily living.

To qualify for benefits from the WA Cares Fund, you must have worked and contributed to the fund for:

- At least ten years at any point in your life without a break of five or more years within those ten years, or

- Three of the last six years at the time you apply for the benefit, and

- At least 500 hours per year during those years.

What if you’re self employed?

Self employed individuals may opt-in to the program to receive the benefits of the trust if/when they need it.

If you have qualifying wages for Paid Family and Medical Leave, they’ll also qualify for WA Cares. In other words, you’re eligible if you’re:

- A sole proprietor.

- A joint venturer or a member of a partnership.

- A member of a limited liability company (LLC).

- An independent contractor.

- Otherwise in business for yourself.

Can you opt-out of the Long Term Care Tax?

Based on the requirements above, contributors to the trust who move outside the state of WA or are set to retire in the next 10 years or less, will have to pay the tax but may never be eligible for the benefit. Under current law, Washington residents have one opportunity to opt out of this tax.

Opting out of the tax must be done by November 1, 2021 and you must buy qualified private long-term care insurance to get out of the public program. For more information about what kind of private insurance qualifies for the exemption, visit the Washington State Office of the Insurance Commissioner website.

While we do not offer long term care, this tax will affect employees and employers we serve and we recommend you contact an expert to help you decide whether or not you should opt-out by purchasing a private policy. Whichever option you choose will be based on your specific life situation and goals. We recommend the following insurance agents who can help you.

Robert Welk

robert@robertwelk.com

509-443-5416

Sarah Foley – New York Life

sfoley00@ft.newyorklife.com

704-607-0703

Amanda Markley – Thrivent

amanda.markley@thrivent.com

509-868-5542

As always, for your non-long term care insurance needs, for your auto, home, business and life, contact us! Call (509) 483-3030 for a fee consultation.